What is Crypto Yield Farming?

Crypto yield farming is a decentralized finance (DeFi) strategy where investors provide liquidity to blockchain protocols in exchange for passive income, typically in the form of interest, trading fees, or governance tokens. Unlike traditional equity investments, yield farming offers higher potential returns with smart contract-managed risk, as lenders earn fixed or variable APYs without taking ownership stakes. Unlike public market bonds, DeFi lending is permissionless, globally accessible, and operates 24/7—but it carries unique risks like impermanent loss and smart contract vulnerabilities, which justify its premium yields.

The Profitability of Market Cycles

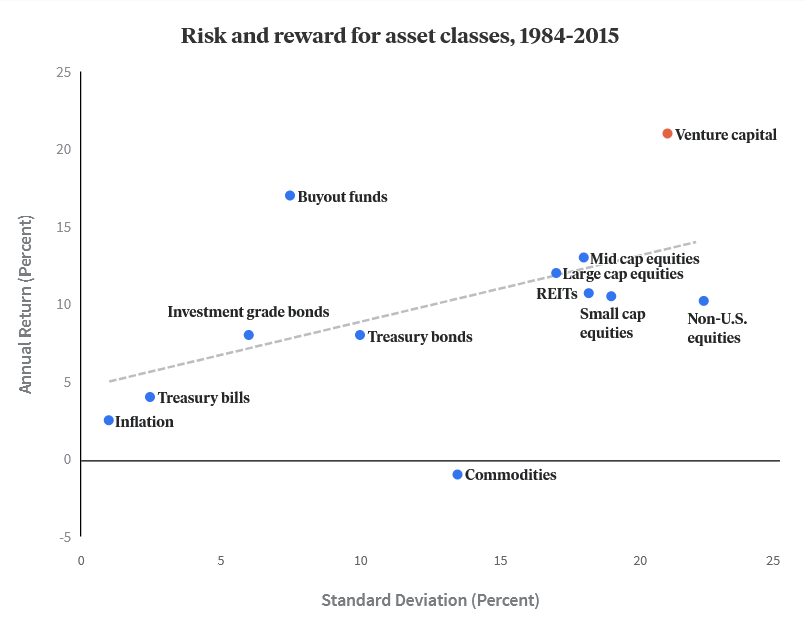

The Fed’s aggressive rate hikes have drained liquidity from risk assets, triggering a crypto winter that we believe has created a generational buying opportunity. When stablecoin yields surpassed 10% APY in 2022—outpacing traditional 30-year bonds—it signaled a market distortion ripe for exploitation.

In this environment, overleveraged crypto projects face existential refinancing risks. Many must now offer unsustainable yields or equity-like token discounts to attract capital. This forces borrowers into "bridge financing" through decentralized lending protocols (e.g., Aave, Compound) or predatory OTC deals—often at terms wildly favorable to liquidity providers.

Meanwhile, investors who accumulated stablecoins during the bear market now hold unparalleled bargaining power. By staking USDC or providing liquidity to blue-chip pools, they can capture 5–15% APY while waiting for the next bull cycle. Our fund is strategically positioned to maximize these asymmetric opportunities.

Important Note: Crypto market inefficiencies rarely last. With Bitcoin halving in 2024 and potential Fed rate cuts, this high-yield window may close within 12–18 months.